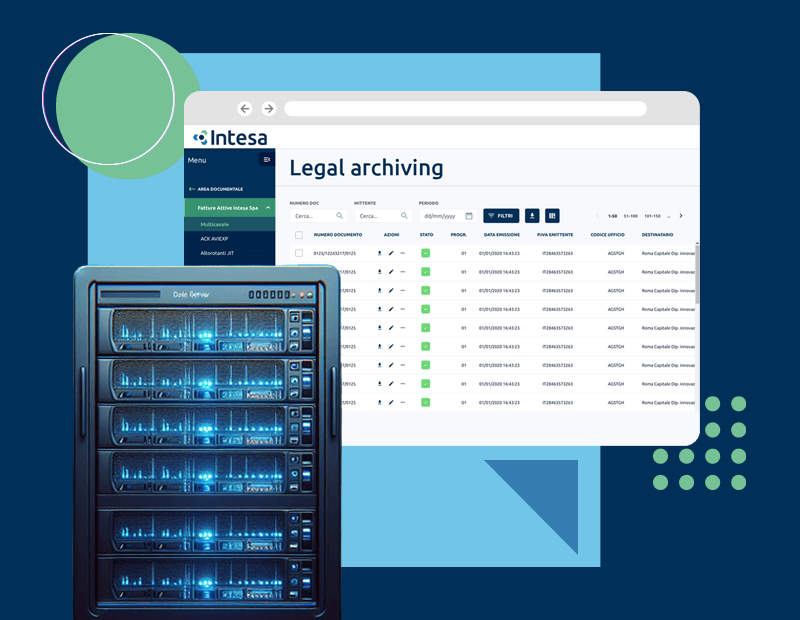

Electronic Archiving

The complete and secure service for the digital preservation of documents ensures compliance with regulations, protection of sensitive data, and certification of the authenticity and integrity of the documents.

Compliant electronic archiving of documents

Compliant digital archiving is a fundamental process that ensures the authenticity, integrity, reliability, readability, and accessibility of digital documents. This advanced system utilizes digital signatures and timestamps to certify the authenticity and integrity of documents, providing complete protection against alterations or tampering. Through the implementation of rigorous security measures, compliant digital archiving offers a reliable solution that adheres to regulations for secure and long-term document storage.

With the compliance e-archiving service, any document can be stored in accordance with the AgID (Agency for Digital Italy) guidelines expressed in the italian Digital Administration regulation. The solution guarantees protection, security, and probative validity of documents over time. The application of a qualified electronic seal and a timestamp to the “archiving package” (composed of documents, metadata, and index) certifies the authenticity and integrity of the documents.

The features of compliant preservation

Our compliant preservation service, in addition to adhering to the Guidelines of the Agency for Digital Italy, provides a range of additional functionalities for document security and retrieval.

- Cloud Storage with Intesa: Your documentation will be securely stored in the Intesa private cloud, accessible anywhere and at any time for clients.

- Digital Signature: Intesa offers the option to affix a digital signature to documents as a completion of the formation process, if required by regulations.

- Advanced Indexing: The platform allows efficient indexing of documents, simplifying file search and management.

- Audit Trail: Every operation on the documents is tracked and recorded for increased transparency and compliance.

Digital Archiving: Benefits for Your Business

Legal Compliance

With Intesa, your organization will always be compliant with regulations on digital document storage.

Data Security

Your documents will be protected from unauthorized access thanks to our advanced security systems.

Easy Access

Intesa’s service allows quick access to your retained documents, simplifying search and retrieval of information.

Cost Reduction

With digital preservation, you will eliminate the costs associated with printing and physical storage of documents.

Request a free consultation

Do you want to understand if this solution suits your needs? Our team of consultants is available to answer all your questions without any obligation.

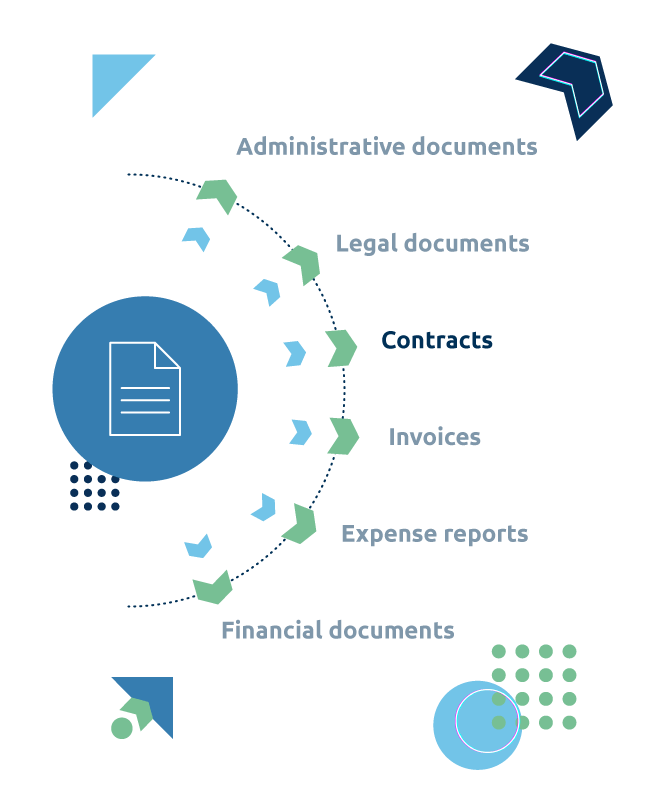

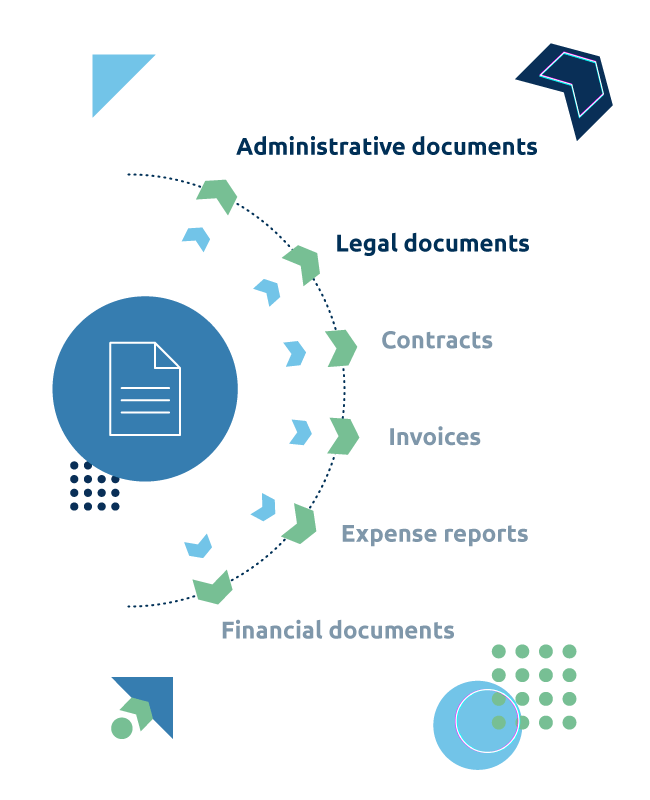

Document Types for Standard Digital Archiving

Standard digital archiving is suitable for a wide range of document types, including:

1. Invoices and Accounting Documents

![]()

2. Contracts and Agreements

Ensure the authenticity and integrity of important contracts and agreements throughout the entire document lifecycle.

3. Legal and Administrative Documents

Securely store your legal documents, contracts, judgments, and other administrative practices, with legal validity guaranteed over time.

5. Financial Documents

Archive financial reports, balance sheets, and other relevant information for financial management and reporting.

Beyond Contracts and Invoices: Compliant Preservation

Compliant preservation isn’t just for storing financial documents or contracts; it can also be utilized for safeguarding sensitive data or archiving correspondences.

Personal Data and Sensitive Documents

Compliant digital preservation provides reliable protection for sensitive data while adhering to privacy regulations.

Email and PEC Correspondence

You can also preserve all email exchanges and PEC (Certified Electronic Mail) communications that you deem important for the regulatory security of the business.

Efficient Management of Employee Expense Reports

Electronic archiving of employee expense reports is a significant advantage for companies, allowing for the secure and organized storage of all expenses incurred by employees.

This process eliminates the need to accumulate bulky piles of receipts and paper documents. Intesa’s compliant preservation solution provides the capability to archive all expense reports and their related justifications and receipts, seamlessly integrating with the most widely used management systems in the market.

This solution streamlines the management of fiscally relevant documents and promotes greater transparency and traceability of expenses, ensuring a more rigorous control over corporate financial resources.

Your documents are safe with Intesa

There are many offers on the market for regulation-compliant document preservation, but only a few enjoy AgID certification.

Intesa is one of the Qualified Conservatories and undergoes audit cycles that test its preservation service to ensure full compliance with current regulations and complete reliability.

In addition to being a Qualified Conservator, Intesa is also an eIDAS Qualified Trusted Service Provider. The guarantee that every company deserves.

Electronic Archiving: Frequently Asked Questions

1. What is digital archiving?

Digital archiving is the way electronic or digital documents can be legally archived. Digital archiving involves more than simple storage in a secure cloud or server; it requires the creation of an “archiving package,” including indices and metadata, performed by a specialized provider

2. How are documents sent for archiving managed?

Documents must be sent to the specialized provider through the agreed-upon communication method. The provider then creates an “archiving package,” conducting formal checks for integrity and format extension, and affixes the qualified electronic seal and timestamp, creating the “archiving package” effectively.

3. What types of documents can be digitally archived with Intesa?

With Intesa, any type of document deemed relevant to the business can be digitally archived, following the formats specified by regulations.

4. Is digital archiving legally valid for tax purposes?

Digital archiving is legally valid for tax purposes if done according to AgID rules and technical specifications. Public administrations also have an obligation to turn to a qualified conservator, and Intesa is among them

5. What is the distinction between substitutive conservation and digital archiving?

“Substitutive conservation” refers to the conservation of analog documents, which are then dematerialized and archived legally. In “digital archiving,” the preserved document is already in electronic format

6. What is the difference between archiving and conservation?

In both cases, it involves saving and archiving important documents on a digital server, but in the case of conservation, the process follows precise standards established and recognized by regulations.

7. What are AgiD guidelines?

Guidelines for digital archiving are described in a document available on the AgID website. Intesa constantly monitors regulations to offer a service that is always safe and up-to-date.

We are at your service

The Intesa team consists of professionals who are reliable and have extensive experience in various market sectors. Do you have any questions? Would you like to schedule a free and no-obligation consultation call? Fill out the form on the side with your request or simply let us know what you need. We will get back to you as soon as possible.

You might also be interested in these services

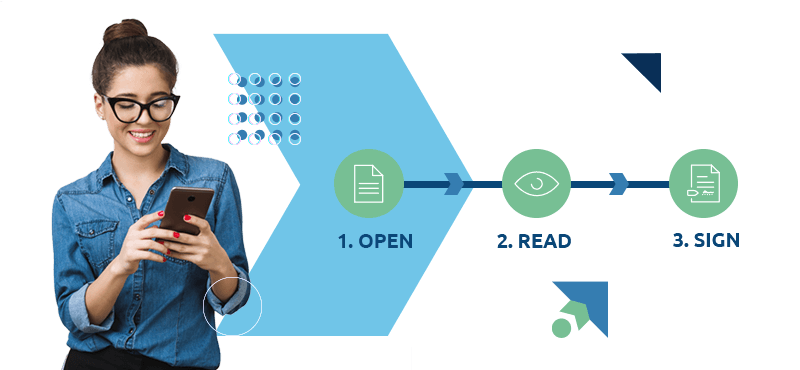

ELECTRONIC SIGNATURE

ELECTRONIC SIGNATURE

Flexibility first

Discover the solution that allows you to apply your Electronic Signature to digital documents quickly, intuitively, and extremely securely. The documents will have the same legal validity as a traditional handwritten signature.

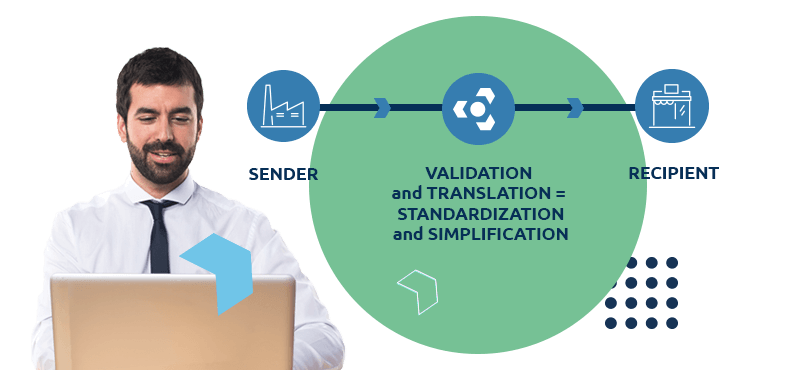

EDI

EDI

Exchange information automatically

Intesa’s Electronic Data Interchange (EDI) application automates supply chain processes and enhances business relationships with partners distributed worldwide.

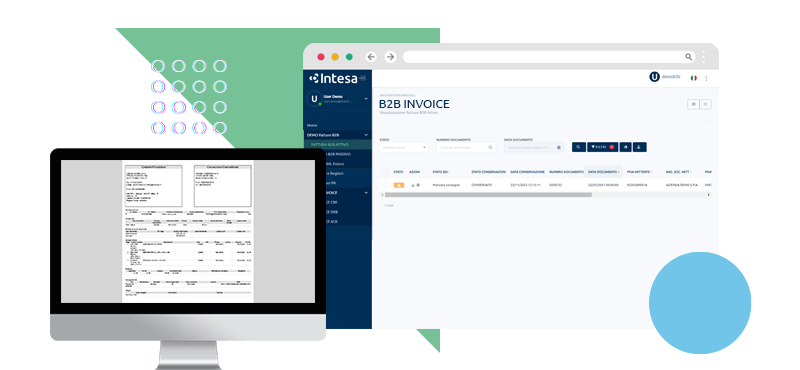

ELECTRONIC INVOICING

ELECTRONIC INVOICING

Professionalism and security, always

Our platform simplifies the invoice exchange process long before electronic invoicing became mandatory.

News and updates about the electronic archiving